Best Trailing Stop Method Forex

What is a trailing end loss

Take y'all e'er wondered how professional traders ride big trends?

You lot know the blazon of trend that keeps going higher and your turn a profit keeps snowballing — while you practise cypher.

Well, the secret is this…

They use a trailing stop loss.

You're thinking:

"It doesn't work."

"I've used it earlier but the marketplace e'er hitting my terminate loss before it trends."

That'southward because:

- You accept the wrong expectations about riding a trend

- You lot're using the incorrect trailing stop loss technique

- Your trailing stop loss is too tight

But don't worry.

I'll teach you how to gear up all these and more in today'southward post.

PLUS, yous'll acquire five powerful techniques to trail your stop loss so you can reduce run a risk and ride MASSIVE trends.

Now if you lot prefer, you can picket this training video below…

What is a abaft end loss and how does information technology work

A trailing stop loss is an order that "locks in" profits as the price moves in your favor.

And you'll just exit the trade if the market reverses by X corporeality.

This is how a abaft stop loss looks similar:

Here's a abaft stop example:

Yous bought ABC stock for $100 and your trailing stop loss is $10.

This means if the price goes higher to $120, your trailing terminate loss is at $110 (120–x).

And yous'll get out the trade if the price drops to $110.

See how it works?

Now you might be wondering…

Why use a trailing stop loss?

Permit's exist honest.

Y'all and I both can't predict how long a trend will last.

Only what you can do is, use a trailing stop loss and take what the market offers you lot.

Disadvantages of Abaft Cease Loss

Now hither'southward the truth:

Almost of the time (even if you use a trailing stop loss), you'll not ride a trend.

Also, it'southward mutual to watch your winners plow into losers — as the price moves in your favor and and so hit your trailing stop loss.

This causes many traders to give up and they'll claim "information technology doesn't work".

But here'southward thing…

If you tin can endure the emotional swings, you lot'll eventually catch a huge trend — possibly achieving a 1 to twenty hazard to reward or more than.

And this is something nigh traders never get to experience because "it doesn't piece of work" for them.

Next…

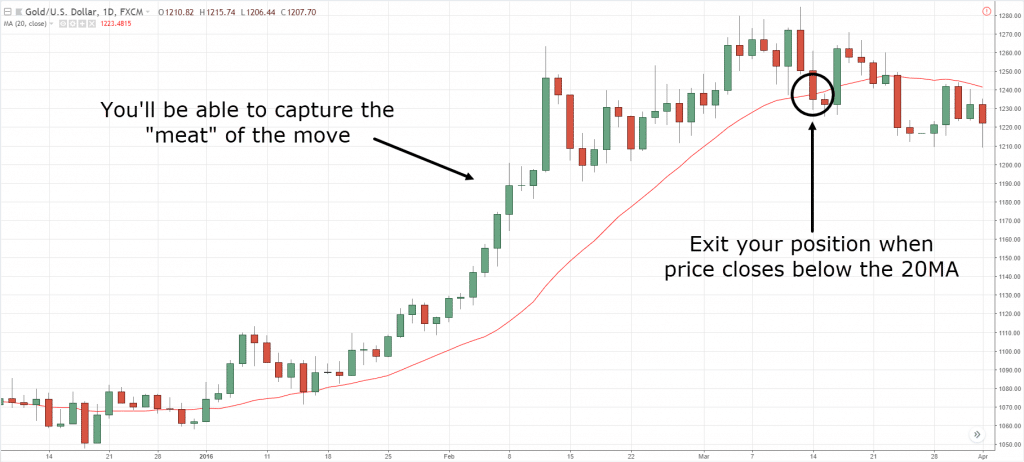

How to trail your stop loss with Moving Boilerplate

The Moving Average is an indicator that averages out the past prices and shows information technology as a line on your chart.

Yous tin can apply it to identify the trend, filter out the "noise", etc.

If y'all want to learn more than, get check out The Moving Average Indicator Strategy Guide.

But for now, allow's learn how to use it to trail your finish loss.

Here's how:

- Decide on the type of tendency yous desire to ride

- Use the advisable Moving Average

- Exit when the toll closes beyond it

This ways if you want to ride a brusque-term trend, you can trail your stop loss with a twenty-period Moving Average (MA) — and exit your merchandise if the price closes across it.

An example:

Pro Tip:

You tin utilize the 50-menses MA to ride the medium-term tendency and the 200-period MA to ride the long-term trend.

Average Truthful Range indicator: How to use it to enormous large trends

Accept you seen traders use a stock-still 20 pip trailing end loss?

Information technology'south a joke.

Because it doesn't consider the volatility of the markets.

Imagine having a twenty pip end loss when the market swings an boilerplate of 200 pips a 24-hour interval.

Information technology's similar flushing money down the toilet bowl.

Then, what's the solution?

You lot can utilize the Boilerplate True Range (ATR) indicator to set a volatility based trailing terminate.

Hither'south how it works…

- Decide on the ATR multiple you'll apply (whether it'due south iii, four, v etc.)

- If you're long, then minus X ATR from the highs and that's your trailing stop loss

- If you're short, so add together Ten ATR from the lows and that'due south your trailing stop loss

To make your life easier, there's a useful indicator called "Chandelier stops" (from TradingView) which performs this function.

Pro Tip:

Y'all can employ 2 ATR to ride the short-term tendency, four ATR for medium-term trend, and 6 ATR for a long-term trend.

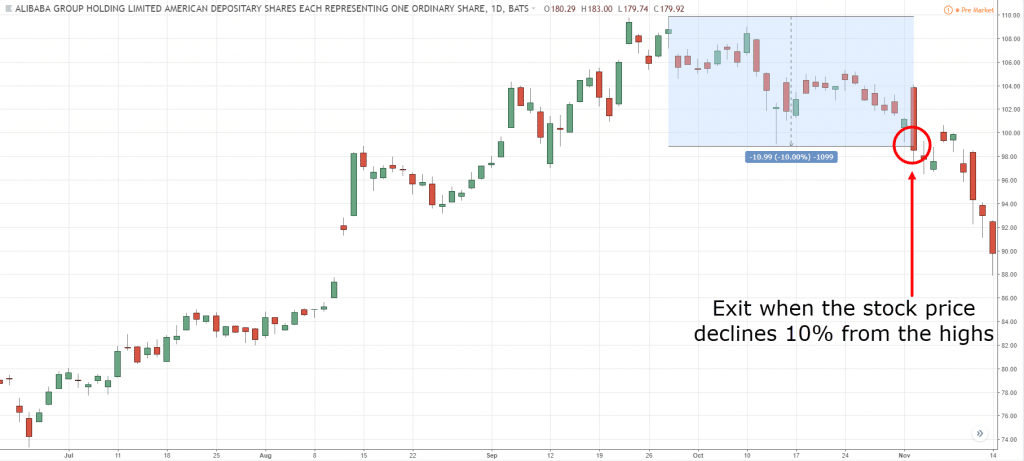

You don't need a chart to trail your stop loss, here's how…

Decide on the trailing end loss per centum where you lot'll exit the trade.

It can be x%, 20%, or whatsoever you decide.

For example:

If yous buy ABC stock at $100 and have a trailing stop of 10%.

This ways if ABC stock drops 10% (from its high), you lot'll exit the trade.

An example:

Pro Tip:

This technique is useful when trading a portfolio of stocks with equal weight for each position.

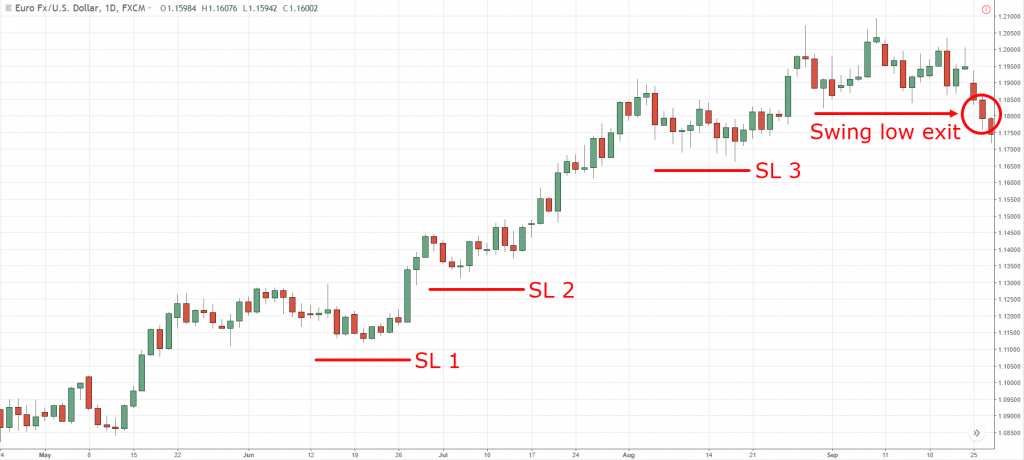

The zero indicator method to trail your stop loss

You know an uptrend consists of higher highs and lows.

This means you can use the swing depression to trail your terminate loss because if the trend holds, information technology shouldn't close below information technology.

Here'south how to do it:

- Identify the previous swing low

- Gear up your trailing stop loss beneath the swing low

- If the toll closes below it, exit the trade

An example…

Pro Tip:

The market tends to "hunt" end losses below Support or swing low.

To avoid information technology, fix your stop loss 1 ATR below the marketplace structure.

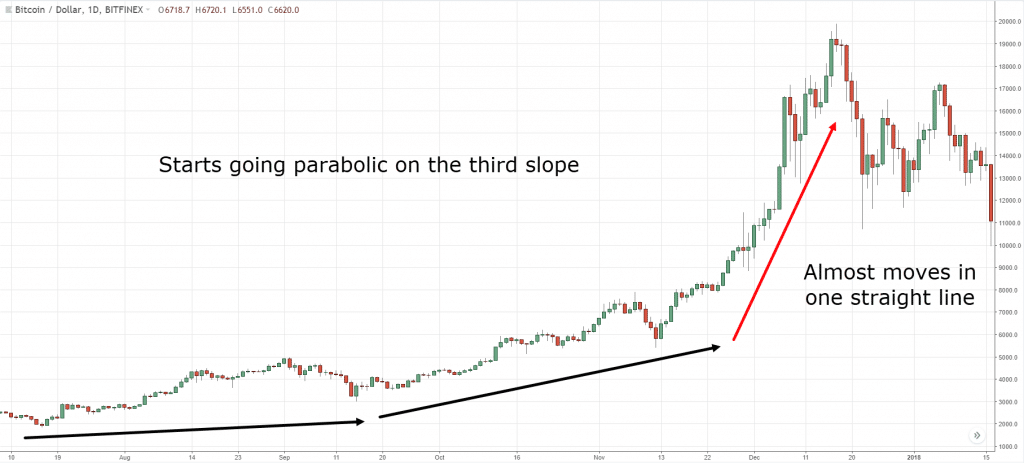

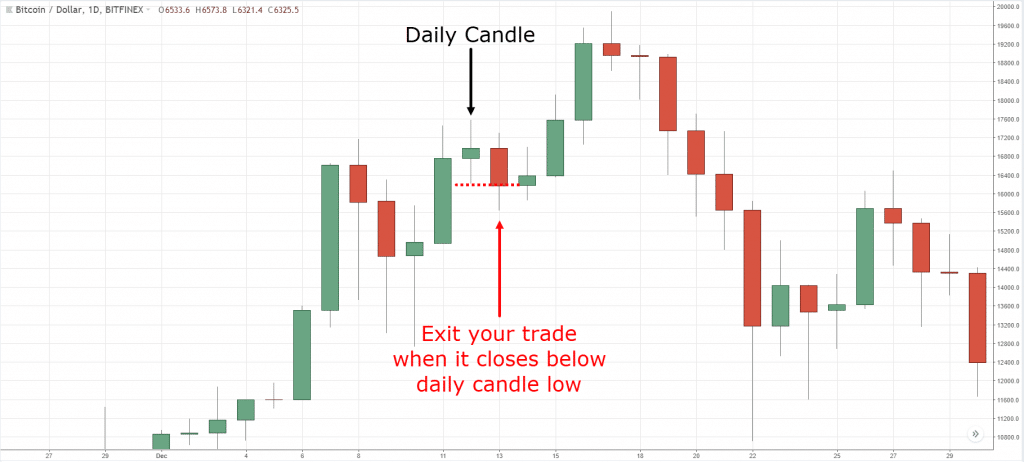

How to trail your end loss when the market goes "crazy"

What do I mean past "crazy?"

Information technology's when the market goes parabolic in 1 directly line (like a rocket taking off).

For case:

Just here'south the thing:

Parabolic moves are non sustainable.

It's a matter of time earlier the market contrary and Plummet.

Then, in market atmospheric condition similar these, you desire to trail your finish loss tightly.

Don't give it too much room to breathe because you desire to "run" at the outset sign of cracks.

Then, how do y'all do it?

- Identify the timeframe of the parabolic move

- Trail your finish loss on the previous candle low

- Exit if the price breaks and close below it

Here's an instance:

As you can see, this technique got you out of Bitcoin at $17,000 — and avoided the collapse.

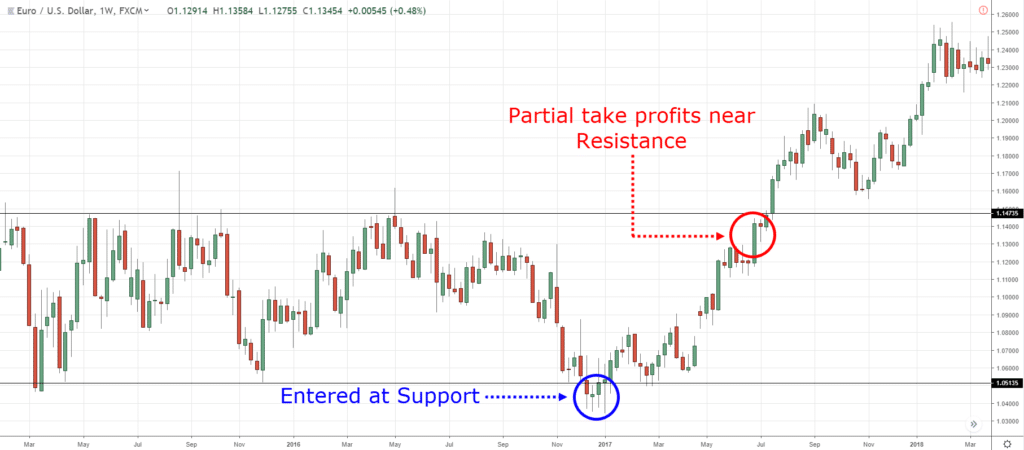

Bonus Trading Tip: How to capture a swing and ride massive trends (at the aforementioned time)

Here's the matter:

In that location's no rule to say yous must either capture a swing or ride a trend.

Instead, you can practice both!

This ways you have the consistency of a swing trader plus, the ability to ride big trends (similar a Trend Follower).

So, how does it piece of work?

Simple.

You exit a portion of your trade at a stock-still target and let the remaining ride the trend.

Here'due south an case:

Partial have profits on EUR/USD Weekly:

Now, there are two things to consider…

- How many units practise you sell at your fixed target?

- How will y'all manage the remaining units?

Let me explain…

1. How many units do you sell at your fixed target?

Here'due south the thing:

If y'all sell too lilliputian units, information technology becomes a Trend Following trade.

And if yous sell besides much, information technology becomes a swing trade.

For starters, you lot can sell 50% of your position at the first target and keep the remaining to ride a tendency.

One time you're adept with this technique, you lot tin "play effectually" with the pct to suit your goals.

2. How will yous manage the remaining units?

You've hitting your commencement target profit, yay!

What now?

Volition y'all endeavor to ride a trend or have a second target profit?

If you lot have a second target profit, where will information technology exist?

If you want to ride a trend, how will you trail your end loss?

Clearly, those are questions only you can answer (and information technology depends on your goals and personality).

So think about information technology.

Now you might exist wondering…

Which is the best strategy to trail your stop loss?

I'll be honest.

There's no best trailing terminate strategy.

Considering it depends on what YOU want from your trading.

For example:

To ride a curt-term trend, you can trail with 20-period MA, two ATR, etc.

To ride a medium-term trend, you lot can trail with 50-period MA, 4 ATR, etc.

To ride a long-term trend, y'all tin trail with a 200-flow MA, 6 ATR, etc.

Practise you meet my point?

The virtually important question to inquire is…

What's the type of trend you want to capture?

And so use the right technique to achieve your goal.

Conclusion

- A trailing stop loss is an guild that "locks in" profits as the price moves in your favor

- You tin trail your end loss using: Moving Average, Average Truthful Range, percentage change, market structure, and weekly high/low

- There'southward no best method to trail your stop loss. Instead, enquire yourself what's the type of trend you want to capture and and then apply the right technique for it

Now here'south my question to you…

How exercise y'all trail your finish loss and ride the tendency?

Leave a comment below and share your thoughts with me on trailing cease loss.

Best Trailing Stop Method Forex,

Source: https://www.tradingwithrayner.com/trailing-stop-loss/

Posted by: chaneyothess.blogspot.com

0 Response to "Best Trailing Stop Method Forex"

Post a Comment