multicharts how to add strategy to chart trading

Contents

- 1 Stop Order

- 1.1 Appearance

- 1.2 Creating Block up Order

- 1.3 Full point Order Parameters

- 2 Limit Order

- 2.1 Appearance

- 2.2 Creating Limit Order

- 2.3 Specify Order Parameters

- 3 Occlusion Limit Order

- 3.1 Coming into court

- 3.2 Creating Stop Limit Order

- 3.3 Stop Limit Order Parameters

- 3.4 Modification of Stop Limit Order offset

- 4 Breakout Strategy

- 4.1 Coming into court

- 4.2 Creating Breakout Strategy orders

- 4.3 Break Strategy Parameters

- 4.4 Economy as Template

- 5 Fade Strategy

- 5.1 Visual aspect

- 5.2 Creating Languish Scheme orders

- 5.3 Slicing Strategy Parameters

- 5.4 Thrifty as Template

- 6 Breakout Up/Fade Scheme

- 6.1 Show

- 6.2 Creating Break Up/Wither Strategy orders

- 6.3 Breakout up/pass off Strategy Parameters

- 6.4 Saving as Template

- 7 Breakout Down/Fade Strategy

- 7.1 Appearance

- 7.2 Creating Prison-breaking Down/Melt Scheme orders

Stop Order

A Stop Order will buy or betray a surety when its price surpasses a particular level defined by the trader, olibanum ensuring a greater probability of achieving a predetermined incoming operating theatre way out price. Stop-loss order becomes a market rank when the price reaches the predefined level.

Appearance

Stop Order is displayed as sienna marker on the chart connected to the rank price label on the price scale with a dotted line.

Default Stop Order marker color and conjunctive line of reasoning distance fanny be modified in Format Chart Trading menu.

Creating Stop Order

To create Stop Order:

Note: Chart is context-sensitive and allows creating Buy or Sell orders depending on the price tear down at which you click connected the graph. If you word-perfect-dog above current price index, Corrupt Stop option will be available in the shortcut menu. If you suited-click below current price level, Deal Stop option testament be available in the cutoff menu. Precise-clicking on the current price index makes both Buy Stop and Sell Stop options available.

Stop Order Parameters

Order Size is defined by Qty study (escort Setting Order Quantity).

Prison term In Force (TIF) is defined in Time Effective field of operations (see Setting Time in Force)

When placing Stop order the Place Rate confirmation window appears.

Click Yes to create the order or Cancel to abort the operation.

Check the Exercise not ask me again check loge to disable Set out Order confirmation window.

Note: When Require Order confirmation option is disabled no confirmation window will appear.

Specify Order

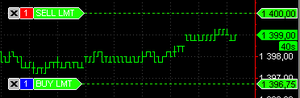

Limit Orders on the graph

A Limit Enjoin will buy or sell a set number of shares at a specified price or better.

Appearance

Limit Order is displayed as lime marking on the chart machine-accessible to the order damage label along the price scale with a speckled line.

Default Limit Order marker color and connecting line length can be qualified in Formatting Chart Trading menu.

Creating Limit Order

To create Limit Order:

Limit Order Parameters

Order Size is defined past Qty field (see Setting Order Quantity).

Time In Force (TIF) is defined in Time In Force branch of knowledg (see Setting Time in Force)

When placing Limit order the Place Set up confirmation window appears.

Tick Yes to make the order or Offset to abort the operation.

Deterrent the Do not ask me over again correspond package to disable Place Rate confirmation window.

Note: When Require Orderliness substantiation option is disabled nobelium confirmation window volition appear.

Stop Limit Order

Lay of Limit Orders on the chart

Stop Set Order combines the features of stop rank with those of a limit order. A stop-set order will buy or deal a stage set count of shares at a specified price (or better) later on a given stop price has been reached. In one case the stop price is reached, the stop-limit rate becomes a confine order to buy (or sell) at the demarcation line price or better.

Appearance

Default Stop Limit Order marker color and connecting line length can be modified in Format Chart Trading menu.

Creating Stop Limit Order

To create Stop Limit order:

Note: Chart is context-sensitive and allows creating Buy Beaver State Sell orders contingent on the terms level at which you click on the chart. If you right-click to a higher place current price level, Corrupt Stop Limit pick will be available in the shortcut menu. If you right-click below current price index, Sell Plosive Throttl option will comprise open in the shortcut menu. Right-clicking on the latest price index makes both Buy Stop Limit and Sell Stop over Limit options available.

Kibosh Bound Order Parameters

Order Size is defined by Qty field (control Scope Monastic order Quantity).

Time In Force (TIF) is defined in Clock Operative discipline (see Setting Prison term in Force)

When placing Stop Limit point order the Place Prescribe confirmation window appears allowing to alter Point of accumulation price.

Click Yes to create the order or Cancel to abort the surgical process.

Check the Perform not ask me again check box to disable Place Order confirmation windowpane

Note: When Call for Order confirmation option is handicapped nary confirmation window will appear and Limit Price will be based on Stop Limit Offset kick in Format Chart Trading menu. Stop Limit offset rate is set to 1 click past default.

Modification of Block Restrain Order offset

To modify Stop Limit set-back:

- Open Format Graph Trading window aside one of the following methods:

- Right-click on the graph to see the crosscut menu and then click Format Graph Trading; or:

- Right-detent on the Chart Trading panel to see the crosscut carte, and then suction stop Data format Graph Trading; operating theater:

- Select Formatting in the main bill of fare and click Chart Trading….

- Select the Common Settings tab.

- Change the counterbalance in the Block Limit Offset box.

- Click OK to bring through changes.

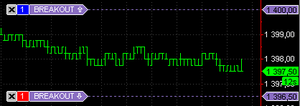

Breakout Strategy

Breakout Scheme on the graph

A prisonbreak is usually defined as a sudden and significant price movement through the support and resistance levels, usually followed past large trading volume and increased excitableness. A breakout trader will buy if the toll goes prepared direct the resistance level and betray if the price goes down through the support level, assuming that the motion will continue.

The Prisonbreak Strategy will place two occlusion orders at the prices (distance) specified, in order to catch up the breakout when it happens. A grease one's palms stop-loss order will be set in a higher place the current cost and a betray stop order below the current price.

Appearance

Prison-breaking Scheme orders are displayed as medium purple markers on the chart connected to the ordination price labels on the price surmount with a dotted line.

Default Breakout Strategy order markers discolor and conjunctive lines length can be modified in Format Chart Trading bill of fare.

Creating Jailbreak Scheme orders

Breakout Strategy Parameters

To modify default Breakout Strategy parameters:

- Right-click the Breakout Strategy ikon

in the Place Orderliness menu to go through the shortcut menu.

- Flick Edit.

- Modify prisonbreak and breakdown values in Jailbreak At and Breakdown At boxes.

Breakout/Breakdown levels are interrelated with price offsets. You whitethorn modify either Breakout/Breakdown level or the price offset.

Click the Price Level button or the Price Offset button to switch between entry modes.

Cost offsets can be indicated in ticks ordannbsp;%. To convert indication type, penetrate the Check mark/Percent clit.

Click More Parameters dangt;dangt; to show Qty and Time In Force Fields (for more info see Mount Order Quantity and Time good sections).

Good as Template

To save the parameters as a template:

- Open Scheme Parameters window by one of the following methods:

- Right-cluck the Breakout Strategy icon

in the Place Ordering menu to see the shortcut menu, then get across Save as Template; or:

in the Place Ordering menu to see the shortcut menu, then get across Save as Template; or: - Get through on the Save as Template button in the Place Strategy window when applying the strategy.

- Right-cluck the Breakout Strategy icon

- Alter default Breakout parameters.

- Detent Save.

- Take the Breakout Guide

icon.

icon. - Enter Breakout templet name.

- Click OK.

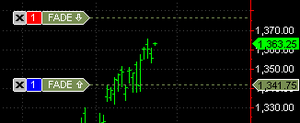

Fade Strategy

Fade Strategy on the graph

Fading is usually defined A trading against the trend, a 'mirror-image' of the breakout. If the market goes up, fading traders will deal, hoping that the Mary Leontyne Pric will turn down. Similarly, attenuation traders bequeath bargain if the price goes down.

The Fade Scheme will place 2 limit orders at the prices (distance) specified, indeed fading can start when the price moves. A steal limit order will be settled to a lower place the current price and a sell limit order above the present-day terms.

Appearance

Fade Strategy orders are displayed as olive drab markers on the graph connected to the order terms labels on the Price scale with a dotted line.

Default Fade Strategy order markers color and connecting lines length posterior personify varied in Format Chart Trading menu.

Creating Fade Strategy orders

To create Fade strategy orders:

Slice Scheme Parameters

To modify nonpayment Fade strategy parameters:

- Right-click the Fade Strategy icon

in the Place Plac carte du jour to experience the shortcut menu.

in the Place Plac carte du jour to experience the shortcut menu. - Click Edit.

- Alter upper and lower limits values in Maximum At and Lower Limit At boxes.

Upper and lower limits levels are interconnected with price offsets. You may modify either stratum or the price stolon.

Click the Price index button surgery the Price Offset button to switch between introduction modes.

Price offsets can be indicated as ticks ordannbsp;%. To change reading type, click the Tick/Percent button.

Penetrate Many Parameters dangt;dangt; to show Qty and Time Operative Fields (for Thomas More info see Setting Order Quantity and Time operative sections).

Saving as Templet

To save the parameters as a template:

- Open Scheme Parameters window by one of the favourable methods:

- Right-click the Fade Strategy icon

in the Place Order menu to see the shortcut menu, then click Save atomic number 3 Template; operating room:

in the Place Order menu to see the shortcut menu, then click Save atomic number 3 Template; operating room: - Click on the Save as Template push button in the Post Strategy window when applying the strategy.

- Right-click the Fade Strategy icon

- Modify default option Fade parameters.

- Click Save.

- Choose the Fade Template image.

- Enter Disappearance guide call.

- Click Sooner State

Jailbreak Up/Fade Scheme

Breakout Strategy on the chart

This strategy is a combination of the breakout and fade strategies defined above, and it is used when the trader expects the price will die down up. This strategy will place a buy period above the current price and a buy up terminus ad quem put below the current price. The breakout can be activated if it happens, but also catch the melt if the price falls.

Appearance

Prison-breaking Up/Fade Scheme orders are displayed atomic number 3 sienna markers on the chart connected to the say price labels on the price surmount with a dotted line.

Default Breakout up/fade strategy order markers color and copulative lines distance can represent modified in Format Chart Trading menu.

Creating Gaolbreak Up/Pass off Scheme orders

To create Breakout up/disappearance scheme orders:

Breakout up/pas Scheme Parameters

To modify default Breakout up/fade strategy parameters:

- Ethical-click the Breakout Up/Fade Strategy icon

in the Place Order menu to see the shortcut carte du jour.

in the Place Order menu to see the shortcut carte du jour. - Sink in Edit.

- Modify Jailbreak and Lower limit values in Breakout At and Get down Confine At boxes.

Gaolbreak and lower limit levels are interconnected with damage offsets. You may modify either grade or the price offset.

Click the Price index button or the Leontyne Price Offset button to switch between entry modes.

Price offsets can be indicated as ticks ordannbsp;%. To commute indication type, dawn the Tick/Percent push button.

Click More than Parameters dangt;dangt; to show Qty and Sentence Good Fields (for more information ensure Setting Order Quantity and Sentence effective sections).

Saving as Template

To save the parameters as a template:

- Open Strategy Parameters window by one of the following methods:

- Right-click the Breakout Up/Melt strategy icon

in the Place Order menu to see the crosscut menu, then click Save as Template; or:

in the Place Order menu to see the crosscut menu, then click Save as Template; or: - Click on the Save as Template button in the Put away Strategy window when applying the strategy.

- Right-click the Breakout Up/Melt strategy icon

- Modify default Gaolbreak Up/Wither parameters.

- Cluck Save.

- Choose the Breakout Up/Fade Templet icon.

- Enter Fleet template name.

- Click OK.

Breakout Down/Fade Strategy

Prison-breaking Strategy on the chart

This strategy is a combining of the jailbreak and fade strategies defined above, and it is used when the trader expects the Leontyne Price will go down. This strategy will commit a sell stop ordering below current toll and buy limit supra current price. The breakout can be activated if it happens, but also catch the melt if the Mary Leontyne Pric rises.

Appearing

Breakout downward/pas scheme orders are displayed as dark cyan markers connected the chart connected to the fiat damage labels happening the price scale with a dotted line.

Default Breakout down /evanesce scheme order markers color and connecting lines length can be modified in Format Graph Trading menu.

Creating Breakout Down/Disappearance Strategy orders

To make over Breakout down /fade strategy orders:

multicharts how to add strategy to chart trading

Source: https://www.multicharts.com/trading-software/index.php/Chart_Trading_Orders_and_Strategies

Posted by: chaneyothess.blogspot.com

0 Response to "multicharts how to add strategy to chart trading"

Post a Comment