Where Are Forex And Cfd Contracts Traded

What is CFD Trading? – Basic tutorial for beginners

CFD definition and explanation:

CFD is the acronym for "contract for divergence". Information technology is an over-the-counter derivative that can be traded on a wide range of assets. In contrast to the classical straight stock substitution trade, CFD trading has several advantages and offers the investor the possibility to conclude an investment with pocket-size besides as large capital. You lot can trade long or short on different markets with leverage.

CFD Trading liquidity providers

Every bit y'all see in the moving picture above, the online banker is selling you a "CFD contract" which is coming from liquidity providers like banks or market makers with special licenses. Some big brokers are also liquidity providers. The bank/liquidity provider is taking the counter risk party and is hedging themself on the markets.

Facts of CFD Trading:

- CFDs are suitable for any amount of money

- Trading on rise and falling markets (long and short)

- Trading with leverage

- Low trading fees

- High liquidity of CFD markets

- Y'all tin utilise professional person trading platforms

How are Contracts For Departure working?

Are you looking for valuable information on the subject of "CFDs"? – And then you are exactly correct on this page. With more 7 years of feel in the financial markets, we will explicate the exciting topic of contracts for divergence. On this page, you lot volition detect the basics and valuable tips.

Contracts for difference are over-the-counter contracts that can merely be purchased from an online broker. When you trade with brokers, y'all conclude a transaction for a contract. The contract is based on an underlying nugget (stock, currencies, commodity, crypto currencies, etc.) and imitates its price ane:1. As an investor, you exercise not own the directly underlying asset, but simply the contract or claim confronting the online broker.

CFD trading ever occurs betwixt the two parties "Banker" and "Trader". In the following sections, we will explicate to yous footstep by pace how trading with contracts for divergence works and what risks and opportunities there are.

Note:

CFD Trading is risky. Yous tin can lose your invested money.

Why were Contracts For Difference (CFDs) developed?

CFDs were adult in the 20th century by a major bank in the United Kingdom to avoid a planned stock exchange tax. This was to apply to all transactions with shares. The tax could be avoided thanks to the clever development of contracts for departure. Today they are a popular financial product for private traders. Read more on the Wikipedia article.

Facts of the history:

- Developed in the U.k. to avoid a stock exchange revenue enhancement

- Developed by major banks

- Today it's a regulated financial product

- Popular for many private traders

Advantages and disadvantages of CFD Trading

The biggest advantage of CFDs is that traders/investors can invest in whatever asset with a modest amount of capital. Traders get very fast and easy access to the markets through an online broker. What was very hard a few years ago has now become very piece of cake thanks to the Internet.

In the following tabular array nosotros accept summarized all advantages and disadvantages for you:

| Advantages: | Disadvantages: |

|---|---|

| Y'all can start with small amounts of money | At that place are some bad brokers and scammers |

| Fast access to the financial markets | Investors sometimes underestimate the take a chance |

| Negative balance protection (not all brokers) | |

| Minor trading fees | |

| No expiry time of CFD contracts | |

| Trading with loftier leverage is possible | |

| You can easily go short on markets |

How prophylactic is CFD Trading? – Information technology is a regulated financial product

Contracts for difference are considered safe financial products or derivatives if they are regulated by official supervisory authorities. For example, the European market for CFD Brokers is fully regulated. The European Financial Regulators impose strict rules on the distribution of these financial products. Trading nether a European license is considered particularly safety.

Financial Bear Dominance regulator (FCA) for CFDs

Contracts for Divergence used to exist a very opaque and unregulated production with many freedoms for brokers. This was gradually restricted. In general, good and well-known CFD Brokers usually take several licenses within and outside the EU, as these companies operate internationally.

Pop regulators are:

- Financial Acquit Say-so (Uk)

- Cyprus Securities and Exchange Commission (Cyprus)

- Australian Securities and Investments Commission (Australia)

CFD Trading Tutorial: How to trade CFDs

Trading CFDs is not always easy for a beginner. Notwithstanding, in the following steps, we will explain exactly how to start successful trading with contracts for differences footstep by step. Even at the beginner level, most traders make many mistakes, so nosotros advise you lot to open a CFD demo account and do trading before yous start making real money.

Too, watch our full video tutorial on CFD Trading:

1. Cull a good and reliable CFD Broker

The pick of online brokers on the internet is limitless and non easy. Beginners are mostly confused by this and pay attending to the wrong components when choosing a provider. The visitor should definitely be regulated, provide a practiced offer, low trading fees, and the necessary service.

In the tabular array below you volition detect the test winners of our CFD Brokers comparison. The providers accept been tested by us to the terminal detail. In the individual reviews, you can likewise read more than information most these providers.

| Broker: | Review: | Spreads: | Advantages: | Open Business relationship: |

|---|---|---|---|---|

| 1. IQ Option | | Starting 0.0 – 0.five pips | + FX & Options | Live-trading from $ten Open up your gratuitous account |

| 2. BDSwiss | | Starting 0.0 pips + variable commission | + Individual offers | Live-trading from $100 Open your free account |

| 3. XM | | Starting 0.0 pips + 3.5$ commission per 1 lot (XM Zip account) | + Proficient conditions | Live-trading from $5 Open your free account |

two. Open the CFD trading business relationship

Setting upwards a trading account is like shooting fish in a barrel nowadays. Create your trading account in a few minutes. All you need is a few personal details, an email address, and a right telephone number. After that, the account should be verified with the necessary documents.

All the providers showed above as well offer you a free CFD demo business relationship with a virtual credit residuum to practice. This account imitates trading with existent money. For a first eolith on the trading account, you lot volition so have various options bachelor (Paypal, credit card, banking concern transfer, etc.).

Account sign up form

How to open a trading account:

- Open a free trading account with ane of the providers presented higher up

- The broker requires personal data from you lot (telephone number, address, proper noun)

- The trading account must be verified with the advisable documents (proof of residence, identity card)

- The trading platforms can be tested in demo accounts with virtual credit

- Deposits piece of work in real-time via various providers (Paypal, credit menu, e-wallets and more)

three. Utilise an intelligent trading platform for assay

The trading platforms of a CFD Broker offer a diversity of analysis possibilities of the existing avails. Adjustable drawing tools and indicators are available for technical assay. Fundamental information (business news) or news on shares can besides be hands viewed.

Own CFD trading strategies can be ready with the aid of the platforms. For a beginner, it is still not e'er like shooting fish in a barrel to get the correct first. Therefore you should definitely have a look at the gratuitous learning materials of the to a higher place-mentioned providers. They as well offer webinars and coachings for a better understanding of trading.

CFD Trading platform screenshot

iv. How to open your CFD position in the markets

CFD trading is similarly structured with every provider since it is ever the same financial product. Select a stock, ETF, currency pair, commodity, or cryptocurrency. Every bit these are leveraged products, you will run into the contract value and the required margin. This information tin be viewed on the broker'southward website.

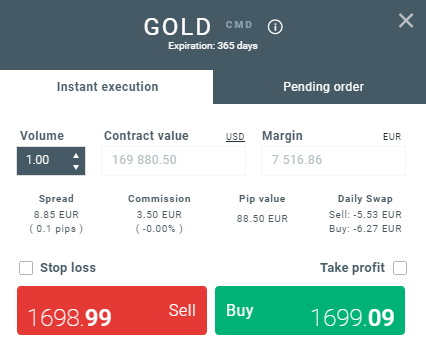

The picture beneath shows a typical order mask of a trading platform. This can vary from provider to provider. However, the process and the information for the trade are in principle always the aforementioned.

Gold CFD contract

Due to the leverage, you lot simply need a smaller security deposit (margin) to trade a college contract value. Leverage makes a lot of sense because certain assets only move in small cost movements per day. For example, if y'all invest only $100, there will just exist profits/losses of a few cents.

Especially in solar day trading, leverage is necessary, because one wants to merchandise simply very small movements of the market. The losses and profits can exist express to every banker. Set an automatic loss limit (Terminate Loss) and profit target (Take Profit) via the order mask.

What yous should know about the order mask:

- A uncomplicated investment in rising or falling prices

- Invest in any asset even with small-scale capital

- It is a leveraged product, therefore but a smaller margin than the bodily contract value is required

- The end loss and have profit are prices where the position is automatically closed (self-adjustable)

- Automatic order openings are possible per limit orders at any price

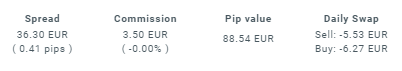

v. Cost and fees of CFD Trading

For traders, in that location are dissimilar fees, which nosotros will explain in the post-obit points. It is of import to empathise that some brokers offering a spread account and a commission account. When commissions are paid, the spread is usually very depression.

Fees for CFD trading

Simply thanks to the cyberspace y'all can consider yourself lucky. The costs and fees have fallen dramatically as a event of the online offering and are continuing to fall year subsequently year. All in all, today you pay only a fraction of the fees you paid 20 years ago. Nevertheless, information technology is worth paying attention to, considering fewer fees mean a bigger profit for y'all.

Costs and fees for CFD traders:

- Spread: Deviation between the buy and sell cost when opening a new position. May depend on the market place situation.

- Commission: Stock-still commission per trade or trading volume.

- Daily Swaps: This is a financing fee that is incurred when a position is held overnight. CFDs are leveraged derivatives that are financed by debt. For special assets, the interest rate bandy can also be positive.

Can you become rich by trading CFDs?

Unlimited profits are possible with CFD trading. There is the dominion:

The higher the capital invested, the higher the profit or loss can be.

With an account of $ 500, it is most impossible to earn several one thousand thousand in a short time. But it is not impossible. In general, i speaks in the trading surface area of run a risk management of well-nigh i% of the total account per position. So if you accept an account with $ x.000 credit, yous should accept a risk of $ 100 in 1 trade. The best traders have traded with a profit-chance ratio of ane to three or more. So you bet $ 100 and win $ 300. Please note, however, that there can also exist losses.

See the instance of a growing CFD business relationship:

Growing CFD account rest

How rapidly you tin attain success depends largely on yourself and the method used in the markets. One time y'all have developed a safe and good tactic for trading, zero stands in the manner of your profit.

The most common failures by CFD traders – Tips & tricks:

In our opinion, the danger of a contract for difference is determined by the traders themselves. It is possible to lose all your trading capital in a brusque time. However, this should not happen with reasonable risk management. The problem of most unsuccessful traders is that they trade with far also large positions in the market.

1. Incorrect trading times:

The trading book of the commutation is based on the official trading hours of a market. Although many markets are electronically tradable 24 hours a day, the strong movements are based on the opening hours. Trading after the off-hours can exist less assisting.

2. Unprepared position opening:

Many traders tend to open a trade unprepared. The most important fact to remember is that you need to adjust the position size of your account. Position size calculators can as well help.

3. Wrong risk management and leverage:

A high level tin can bring many advantages, peculiarly if y'all simply want to merchandise very small-scale movements. However, you should exist able to assess your risk at whatsoever time and adjust it to your account size. Too high a gamble tin can cause strong, sick-considered emotional actions.

Risk of CFD Trading

Stock exchange trading is never hazard-gratuitous. A trader ever tries to risk his capital letter to brand a bigger profit. People who do not want to have any risk should keep their hands off CFD Trading. Although CFDs are very risky, they are less risky than many other financial products. With the new regulations, at that place is no longer an obligation to make margin calls and in the worst case, the business relationship tin can no longer cease up in a negative balance.

Risk of CFD Trading:

- Yous can lose your invested amount of money.

- CFDs are leveraged. This can be risky for your majuscule.

- Without sensitive adventure direction, you will neglect. Do not utilize too much coin for one position.

Decision: CFDs are a proficient style to invest in the fiscal markets

In the past, we have already gained a lot of experience with the topic of Contract for Departure. It is a good opportunity for me to participate quickly and easily in the capital markets. We have tested and tried out a wide variety of providers. There are, as in every field, good and bad brokers.

In summary, the Contract for Difference is the perfect financial production for the individual trader. CFD Brokers offer you trading starting at 1€. The upper limits are open. With the chart analysis and various trading indicators, y'all can also detect perfect entries into the markets.

Information technology does non affair which strategy or method you follow in the financial markets. Contracts for Divergence are suitable for every private trader. Showtime now even in a free demo business relationship with our recommended brokers.

Contracts for Difference are suitable for whatsoever blazon of majuscule. It is an easy way to go long or short on markets with leverage.

(Risk Alert: Your majuscule is at risk)

Source: https://www.trusted-broker-reviews.com/cfd-trading/

Posted by: chaneyothess.blogspot.com

(5 / 5)

(5 / 5)

0 Response to "Where Are Forex And Cfd Contracts Traded"

Post a Comment