What Are The Best Forex Indicators

Success comes from knowledge – this is true for almost things in life and specially Forex trading. To become successful, a trader needs to learn technical analysis. Technical indicators are a big function of technical analysis.

The problem is that, at outset sight, names of technical indicators can sound unpleasantly complicated, for example, MACD, RSI or Stochastic. However, we recommend you non to judge a volume by its cover. We will provide you with a off-white and uncomplicated caption of the near popular technical indicators. We guarantee that yous will understand how to apply them. Are you interested? Permit's offset then!

Do technical indicators actually work?

We merchandise to get a positive result or, in other words, profit. Many beginner traders are eager to know whether technical indicators are able to give them good trading signals.

The truth is that technical indicators won't automatically lead you to profit, simply they will do a lot of work for y'all. There are no doubts that a skillful and experienced trader can achieve profit without indicators, but they can still assist a lot.

In fact, technical indicators can practice a few wonderful things:

- show something that is not obvious;

- help to find a trade thought;

- salvage time for market analysis.

Every technical indicator is based on a mathematical formula. These formulas make fast calculations of diverse price parameters and and so visualize the upshot on the nautical chart. You don't need to calculate annihilation yourself: just get to MetaTrader carte, click on "Insert" and and then cull an indicator you would like to add together to the nautical chart.

At the same fourth dimension, technical indicators make their calculations just on the basis of a price – the currency quotes, which are reordered in the trading software. As a result, indicators do have weak spots: they can give signals which lag behind the price (for example, the price has already fallen when the indicator finally gives a signal to sell).

The good news is that in that location are means to get a lot of benefits from technical indicators. We are going to explain how to do information technology in the paragraph that follows.

The best technical indicators for Forex traders

Technical indicators are divided into several groups depending on their purpose. As purposes of the indicators are different, a trader needs not one, but a combination of several indicators to open up a trade. In this article, we volition tell almost the 3 nearly popular technical indicators.

1. Moving Average – an indicator to identify the trend

Moving Boilerplate (MA) is a trend indicator. It helps to identify and follow the trend.

Technical principle: MA shows an boilerplate value of a toll over a chosen time menses.

In uncomplicated terms: Moving Average follows the price. This line helps to smooth the cost volatility and become rid of the unwanted price "racket", so that you focus on the chief tendency and not on corrections. It is necessary to empathise that this indicator does not predict the future price, but outlines the electric current direction of the market.

Advantages of Moving Average:

- identifies a direction of a tendency;

- finds trend reversals;

- shows potential support and resistance levels.

Disadvantages of Moving Boilerplate:

- lags behind the electric current price (will change more slowly than the cost chart considering the indicator is based on the past prices).

Tips:

- In that location are iv types of the Moving Averages – uncomplicated, exponential, linear weighted and smoothed. The departure betwixt them is merely technical (how much weight is assigned to the latest data). We recommend you to use Uncomplicated Moving Boilerplate every bit most traders use this line.

- The most popular time periods for MA are 200, 100, 50 and 20. 200-flow MA may help to analyze a long-term "historical" trend, while the 20-period MA – to follow a brusque-term trend.

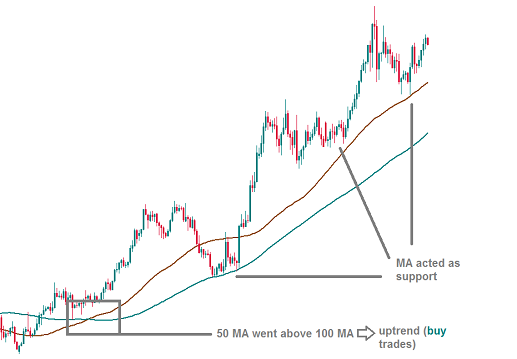

How to interpret

In curt, a trend is bullish when the cost of a currency pair is above the MA and surly – when the price falls below. In addition, notation how Moving Averages with different periods comport towards each other.

Upwards bias is confirmed when a shorter-term MA (east.thou. 50-period) rises above the longer-term MA (eastward.chiliad. 100-period). And vice versa, a downward bias is confirmed when a shorter-term MA goes below the longer-term MA.

Conclusion

Moving Average shows whether to buy or sell a currency pair (buy in an uptrend, sell in a downtrend). MA won't tell you at what level to open your merchandise (for that you'll demand other indicators). Equally a outcome, applying a trend indicator should exist among the beginning steps of your technical analysis.

2. Bollinger Bands – an indicator to measure out volatility

Bollinger Bands helps to measure market place volatility (i.eastward. the degree of variation of a trading toll).

Technical principle: Bollinger Bands consist of 3 lines. Each line (band) is an MA. The middle band is usually a 20-menstruation SMA. It identifies trend direction – just like the MAs described above practice. Upper and lower bands (or "volatility" bands) are shifted by 2 standard deviations above and below the middle ring.

In uncomplicated terms: Bollinger Bands indicator puts the price in a kind of box between the two outside lines. The price is constantly revolving effectually the eye line. It can get and test levels beyond the outside lines, just only for a brusk period of time and it won't be able to get far away. Afterwards such deviation from the center, the toll will have to return back to the middle. Y'all can besides notice that during some periods of fourth dimension Bollinger lines come closer together, while during other periods of time they spread and the range becomes wider. The narrower the range, the lower is marketplace volatility and, vice versa, the bands widen when the market becomes more volatile.

Advantages of Bollinger Bands :

- The indicator is really slap-up in a sideways market (when a currency pair is trading in a range). In this example, the lines of the indicator can be used as back up and resistance levels, where traders can open their positions.

Disadvantages of Bollinger Bands:

- During a strong trend, the price can spend a long time at one Bollinger line and non get to the opposite one. Equally a issue, we don't recommend Bollinger Bands for trending markets.

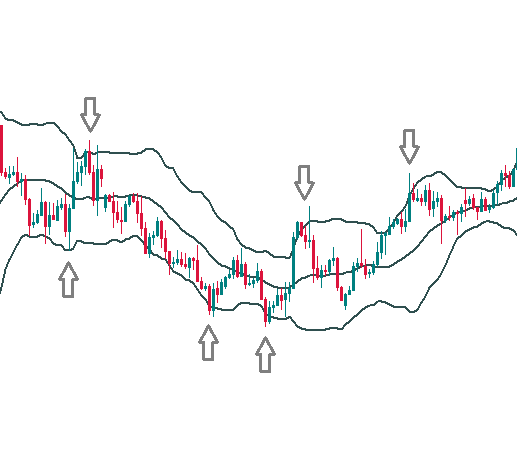

How to interpret

The closer the price approaches the upper band, the more than overbought the currency pair becomes. To put it but, by this time buyers take already fabricated money on the advance of the cost and close their trade to have profit. The event is that the overbought pair stops rise and turns downwards. The price's rising above the upper band may exist a selling signal, while a decline beneath the lower band – a ownership signal.

The outer bands automatically widen when volatility increases and narrow when volatility decreases. High and low volatility periods normally follow each other, so the narrowing of the bands often ways that the volatility is about to increase sharply.

Tips:

- We don't recommend to use Bollinger Bands without confirmation from other indicators/technical tools. Bollinger bands go well with candlestick patterns, trendlines, and other price actions signals.

Conclusion

Bollinger Bands work best when the marketplace is non trending. This indicator can be a great footing for a trading organisation, only it alone is non enough: you'll need to use other tools too.

3. MACD – an indicator that shows the phase of the market

MACD (Moving Average Convergence/Divergence) measures the driving force behind the market place. It shows when the market place gets tired of moving in i direction and needs a balance (correction).

Technical principle: MACD histogram is the difference between a 26-period and 12-flow exponential moving averages (EMA). It also includes a point line (9-period moving boilerplate).

In simple terms: MACD is based on moving averages, merely it involves another formulas besides, so it belongs to a type of technical indicators known oscillators. Oscillators are shown in separate boxes below the toll chart. After an oscillator rises to loftier levels, it has to turn dorsum down. Ordinarily and then does the price chart. The deviation is that while MACD needs to render close to 0 or lower, the price's decline will likely be smaller. This is how MACD "predicts" the turns in price.

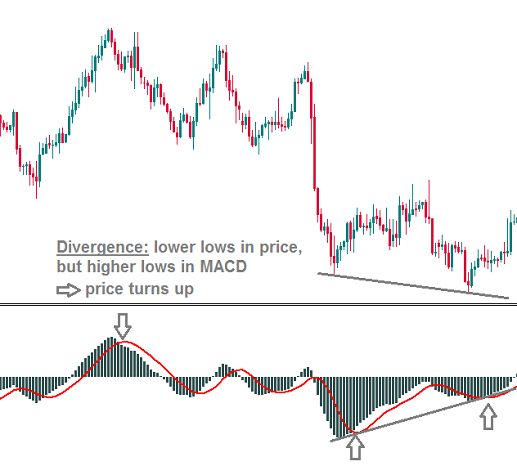

How to interpret

- Dramatic Rise/Autumn. Sell when histogram confined start declining later a big accelerate. Buy when histogram confined start growing later on a big turn down.

- Crossovers betwixt the histogram and the signal line tin brand market entries more precise. Buy when the MACD-histogram rises higher up the bespeak line. Sell when the MACD-histogram falls below the signal line.

- Naught line equally additional confirmation. When MACD crosses the zero line, information technology also shows the strength of bulls or bears. Buy when the MACD-histogram rises above 0. Sell when the MACD-histogram falls below 0. Notation though, that such signals are weaker than the previous ones.

- Divergence. If a price rises and a MACD falls, information technology means that the advance of the price is not confirmed by the indicator and the rally is about to finish. On the opposite, if a price falls and MACD rises, a bullish turn in the near-term.

Tips

- Crossovers betwixt the histogram and the indicate line are the all-time betoken from MACD.

- Hunt for divergences between MACD and the toll: it'southward a good indication of an upcoming correction.

Advantages of MACD:

- MACD can be used both trending or ranging markets.

- If you lot understood MACD, information technology will exist easy for y'all to learn how other oscillators piece of work: the principle is quite like.

Disadvantages of MACD:

- The indicator lags behind the price nautical chart, so some signals come late and are not followed by the stiff motility of the market.

Conclusion

It's skillful to take MACD on your nautical chart every bit it measures both tendency and momentum. Information technology can be a strong part of a trading system, although we don't recommend to make trading decisions based only on this indicator.

What have nosotros learned most technical indicators

- Technical indicators have both advantages and disadvantages.

- 1 technical indicator won't give you lot a good trading signal. You need to utilise two-4 indicators for trading.

Similar

How to Find a Short Squeeze

Exercise you remember the growth of Tesla stock in 2020? Or how about GameStop soaring 10 times in mere weeks? This is neither an "organic growth" nor a market manipulation. These events are called "Short squeezes" and I will evidence yous how to find ane and earn on information technology!

Strategy For Flat Trading: Rubber Ring

Although the marketplace is apartment 70% of the time, nigh of the trading strategies are for trend trading. Thus, almost traders use only thirty% of the trading potential! If y'all want to exist more productive, pay attention to this strategy.

Source: https://fbs.com/analytics/tips/technical-indicators-every-trader-should-know-6587

Posted by: chaneyothess.blogspot.com

0 Response to "What Are The Best Forex Indicators"

Post a Comment